Record-breaking demand in Warsaw for Q2 2015. Regional markets still in great shape - in H1 2015, historically highest levels of office demand were recorded. Approximately 1.4 million sq m of modern office space is currently under construction across the country.

Warsaw, 29 July 2015 – International advisory company JLL presents its H1 2015 summary and key trends for Poland's office market in the coming months.

Tomasz Czuba, Head of Office Agency at JLL, says: "H1 2015 was a very intense time on the Polish office market. Up to the end of June, gross demand in the country totalled 690,000 sq m, and the major markets outside Warsaw experienced another period of record-breaking demand for office space – 298,650 sq m in H1. In addition, Warsaw saw a great deal of tenant interest with Q2 setting a record in terms of demand. Developer activity continued apace. In H1, the market expanded by approx. 345,000 sq m of new office supply, with Warsaw accounting for almost 147,000 sq m, Poznań – 50,700 sq m, and Wrocław – 43,900 sq m. Currently, approximately 1.4 million sq m of modern office space is under construction in Poland."

Tomasz Czuba, Head of Office Agency at JLL, says: "H1 2015 was a very intense time on the Polish office market. Up to the end of June, gross demand in the country totalled 690,000 sq m, and the major markets outside Warsaw experienced another period of record-breaking demand for office space – 298,650 sq m in H1. In addition, Warsaw saw a great deal of tenant interest with Q2 setting a record in terms of demand. Developer activity continued apace. In H1, the market expanded by approx. 345,000 sq m of new office supply, with Warsaw accounting for almost 147,000 sq m, Poznań – 50,700 sq m, and Wrocław – 43,900 sq m. Currently, approximately 1.4 million sq m of modern office space is under construction in Poland."

Demand - a record-breaking Q2 in Warsaw

The space leased on the Warsaw office market totalled 390,200 sq m in H1, of which 221,100 sq m was accounted for by Q2 2015's record-breaking performance.

“Interestingly, the volume of leased space in the second quarter in the City Centre Fringe district caught up with that of Mokotów district - to date the most popular tenant choice. The central districts accounted for 36% of demand, confirming a temporary shift in the center of gravity toward the City Centre Fringe, particularly the surroundings of Daszyński Roundabout,” adds Tomasz Czuba.

Almost 255,000 sq m of office space leased in H1 in Warsaw was for new deals and a further 29,700 sq m constituted expansions. Net take-up accounted for 73% of total demand. The positive sentiment in the leasing market is expected to continue for the remainder of 2015 and in 2016, according to JLL.

H1 2015 saw a record-breaking demand of 298,650 sq m outside Warsaw [1], with a 35% share registered in Kraków. A recovery has been witnessed in Poznań, with demand already exceeding the city’s volumes for the whole 2014. The business services sector continues to be a strategic tenant on regional markets.

Supply

In H1 2015, approximately 147,000 sq m of modern office space came on stream in Warsaw, almost 88,000 sq m of which came in Q2 alone. The largest Q2 openings included Postępu 14 (34,300 sq m) and Spektrum

Tower (27,300 sq m) – both completed in Q2, with Pacific (17,600 sq m) opening in Q1.

Development activity in Warsaw remains strong, with more than 725,000 sq m under construction and some 28,000 sq m under refurbishment. It is estimated that approximately 46% of the 207,000 sq m of office space, planned for delivery over the course of H2 2015, is pre-leased.

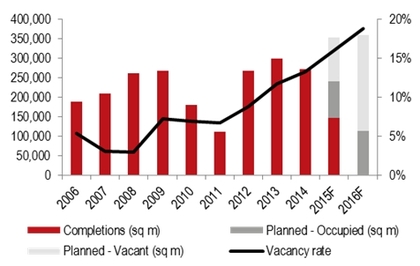

Office completions (sq m), future supply (sq m) and vacancy rate (%)

Source: JLL, PORF, Q2 2015, F-forecast

In H1 2015, 198,000 sq m of office space was commissioned for use (Q2 accounting for 107,700 sq m) outside Warsaw. The most active regional markets in terms of new supply in H1 were Poznań and Wrocław, with Business Garden in Poznań (40,600 sq m, Q1), Olivia Six in Tri-City (17,300 sq m.,Q2) and West Gate (16,000 sq m,Q2) in Wrocław being among the largest completed buildings in the first half of the year.

“The under construction pipeline in regional markets totals over 650,000 sq m. 21% of all office space under development is already pre-let,” comments Anna Bartoszewicz-Wnuk, Head of Research and Consulting at JLL.

Vacancy rate

Q2 saw a further uptick in the vacancy rate, which stood at 14.1% (17.5% in the CBD, 13.5% in the City Centre Fringe and 13.7% in Non-Central locations). JLL expects the rate will continue to grow with new office completions planned for delivery in H2 2015 and 2016.

The increase in supply, which coincides with record rates of demand, has stabilized vacancy rates in major agglomerations outside Warsaw or have recorded slight declines, for example in Poznań and Kraków. The lowest vacancy rates were recorded in Kraków (5.3%) and Łódź (7.7%), while Poznań (21.7%) and Szczecin (15.6%) had the highest.

Stock (sq m) and vacancy rate in main office markets outside Warsaw after Q2 2015

Source: JLL, Q2 2015

Rents

Prime rents in Warsaw fell slightly over the course of Q2, despite the healthy levels of demand. Currently, the highest prime headline rents in Warsaw City Centre range between €21 and €23.5 / sq m. / month. and €11 to €18.0 / sq m/ month in Non-Central locations.

The lowest rents are still in Lublin (€11 to €12 / sq m / month) while the highest can be found in Poznań, Wrocław and Kraków (€14 to €14.5 / sq m / month).

“2014 was very good for regional cities and H1 2015 undoubtedly confirms that this trend has been maintained. In our opinion, last year's record demand will be beaten again this year. Development activity remains buoyant, illustrating that the market favors companies seeking offices, and that tenants will have a wider choice of locations and building standards, as more new projects will be commissioned for use. However, this record-breaking new supply that will be delivered means that not all markets will remain stable in terms of vacancy rates. Despite the strong demand, the vacancy rate may increase, for example in Kraków or the Tri-City. On the other hand, in the cities with currently the highest vacancy rate, Poznań being a case in point, this index will stabilize due to the small volume of space under construction and demand expected to be higher than in 2014”, summarizes Anna Bartoszewicz-Wnuk.

[1] Kraków, Wrocław, Tri-City, Katowice, Poznań, Łódź, Szczecin and Lublin