Since the beginning of the year, business services centres with foreign capital have leased ca 200,000 sq m in around 100 agreements signed in major office markets outside Warsaw.

This accounts for 63,5% of overall office demand outside Warsaw

Warsaw, 12 December 2014 –2014 has been another period of dynamic growth for the business services sector in Poland. Due to the transfer of increasingly complex processes to Poland, the development of companies operating in the country and a systematic increase in employment, there has been a surge in demand for office space. For several years now, business services centres with foreign capital have been the key engine for the development of office markets outside Warsaw. Furthermore, lease agreements signed by companies from the sector are usually characterized by a large volume of space comparable to space occupied by the largest financial and telecommunications companies.

Anna Młyniec, Head of Office Agency and Tenant Representation, JLL, commented: “In 2014, business service centres with foreign capital have maintained their position as key office tenants outside Warsaw. There is no full-year data available yet, nevertheless, the latest data by JLL shows that since the beginning of the year until the end of September, business services centres with foreign capital have signed ca 100 lease agreements totalling about 200,000 sq m of office space. This accounts for 63,5% of overall demand and means that, after only three quarters of the year, the demand generated by the sector has already hit 2013's total. This high demand, which has been maintained for several years, is a result of a systematic increase in employment in business services centres with foreign capital, located in the biggest Polish cities.”

Piotr Dziwok, General Manager, Shell Business Operations Krakow, Country Chair, Shell Polska Sp. z o.o., Vice President of ABSL, said: “According to ABSL, business services centres with foreign capital employ over 130,000 people in Poland. Amongst the 325 investors from 28 countries that operate in 470 centres throughout Poland are such prestigious companies as: Shell, HP, IBM, Capgemini, PwC, Samsung, GE or BNY Mellon. For several years, seven Polish cities, namely Kraków, Warsaw, Wrocław, Tri-City, Katowice, Poznań and Łódź, have been listed as the most attractive locations for investments from the sector. The biggest location for business services sector is still the capital of the Małopolska region. Kraków occupies the leading position in terms of employment in the sector –85 services centres with foreign capital are located here and employ around 30,600 specialists, an increase of 5,000 on last year. This means that Kraków ranks first in terms of employment growth”.

As a result, of this continued expansion of the business services sector, the Kraków market continues to see great demand for office space.

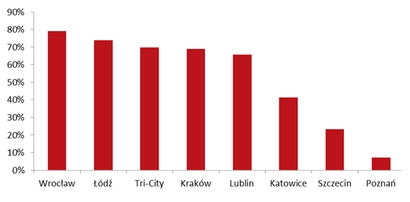

Anna Bartoszewicz-Wnuk, Head of Research and Consultancy, JLL, added: “The business services sector has leased more office space in Kraków – over 74 000 sq m - than in any other city. This accounted for almost 69% of overall office demand recorded in Kraków since the beginning of 2014. Interestingly, in terms of the business services sector share in overall office demand, Wrocław leads the way with over 79% share, followed by Łódź with nearly 74% (due to the lease agreement signed by Infosys) and Tri-City coming in third with almost 70%”.

During Q1 – Q3 2014, the biggest lease agreements signed by companies from the sector were: Infosys in Łódź (21,000 sq m in Green Horizon), HP GBC in Wrocław (16,400 sq m in Dominikański) or HSBC in Kraków (10,500 sq m in Kapelanka 42).

The share of lease agreements signed by foreign companies from the business services sector in the total office demand volumes in the largest agglomerations outside Warsaw

Source: JLL, Q3 2014

According to JLL, foreign companies from the business services sector operating in Poland occupy approximately 1,300,000 sqm of office space. The share of the business services sector in occupied space totals around 55% in Kraków, 44% in Łódź and 41% in Wrocław.

JLL was the first advisory company in the real estate market to recognize the potential of the modern business services sector as one of the most rapidly developing branches of the Polish economy as well as being the key tenant of new office schemes in major cities outside Warsaw. In the period from the beginning of January to the end of September, the company advised on 24 transactions signed by services centres with foreign capital on office markets outside Warsaw. This illustrates JLL’s position as the undisputed leader in this market segment.